An ever-increasing number of companies are preparing for the EU sustainability reporting obligation (CSRD; Corporate Sustainable Reporting Directive) are dealing with sustainability and, in particular, climate risks. The companies consider two perspectives for this:

- Inside-out perspectivethe company causes risks to the environment and society (e.g. greenhouse gas emissions)

- Outside-in perspectiveRisks for the company due to developments in the environment and society (e.g. increasing extreme weather events)

Operational risk management is faced with completely new challenges, as many of the identified sustainability risks cannot be integrated into existing management structures, or only with great effort. In the following 5 steps, we explain how climate risks in particular can be identified and assessed in risk management.

Contents

- Step 0 - Climate risks in the EU sustainability reporting obligation (CSRD)

- Step 1 - Define climate risks

- Step 2 - Defining scenarios for climate risks in risk management

- Step 3 - Identification of climate risks

- Step 4 - Selection of identified climate risks

- Step 5 - Assessment of climate risks in risk management

- Conclusion

Step 0 - Climate risks in the EU sustainability reporting obligation (CSRD)

The European Sustainability Reporting Standards (ESRS) require reporting on the actual and expected financial impact of material climate risks. Financial materiality is to be determined on the basis of the combination of the probability of occurrence and the potential extent of the financial impact. Both physical and transitory climate risks are to be considered, as explained in step 1.

- ESRS 2 SBM-3 contains the detailed requirements for reporting on actual financial effects.

- ESRS E1-9 contains the detailed requirements for reporting on the expected/potential financial impact of climate risks.

Step 1 - Define climate risks

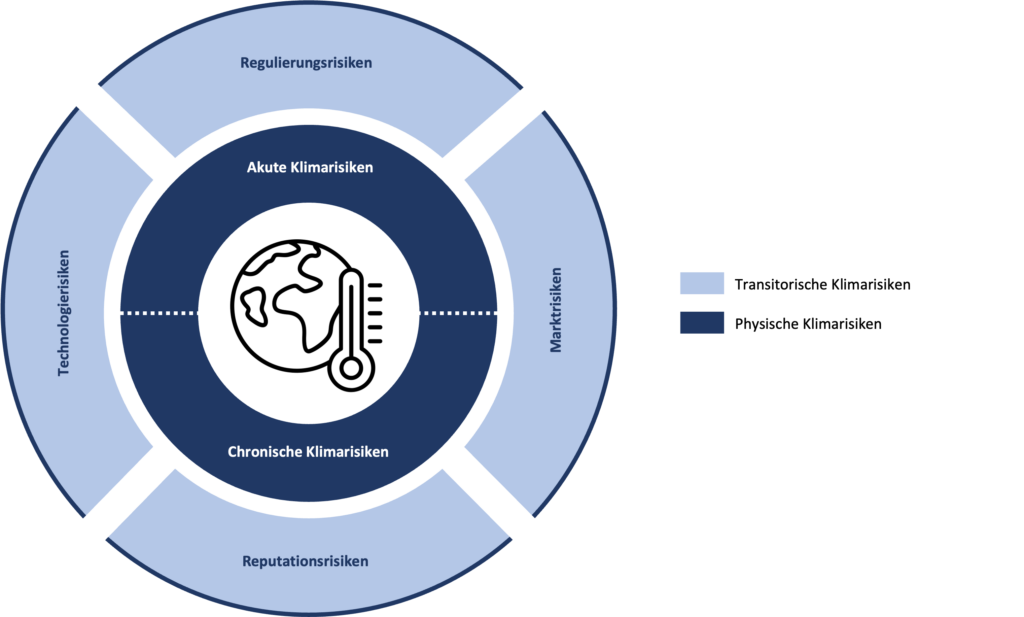

In principle, the term "climate risks" is used to summarise all risks resulting from ongoing climate change. In our advisory projects, it has proven useful to apply the definition framework of the Task Force on Climate-related Financial Disclosures (TCFD for short) for climate risks. The TCFD is a special working group of the Financial Stability Board of the G20 (for further information on TCFD). The TCFD definition framework distinguishes between two categories of climate risks: (1) Physical climate risks and (2) Transitory climate risks. Each category comprises several risk types (see figure: Climate risks according to TCFD).

The core is formed by the classic, Physical climate risks.

- Acute climate risksIndividual extreme weather events caused by climate change and their consequences (e.g. heavy rainfall)

- Chronic climate risksLong-term changes in climatic conditions (e.g. changes in ocean and air currents)

Added to this are the transitory climate risks. This category summarises all types of risk associated with the transformation to a low-carbon economy and society.

- Regulatory risksRisks from political measures and lawsuit risks in connection with climate change (e.g. expansion of emissions trading)

- Market risksRisk of changing supply and demand structures and changes in market prices (e.g. loss of demand for products with a high greenhouse gas footprint due to social change)

- Reputational risksRisk of changing perception by society due to the company's contribution to climate protection (e.g. damage as a result of questionable or non-transparent use of the term "climate neutral" for products)

- Technology riskRisk of a transformation towards lower-emission technologies that is too fast for the company (e.g. risk that the company's own production machines no longer meet customer requirements before the end of their operational amortisation periods, specifically a customer's climate-transformed supply chain - risk of stranded assets)

The TCFD definition framework for climate risks was also integrated into the EU guideline for climate-related reporting in 2019. We recommend the following documents for more details on the definition of climate risks:

- EU guideline for climate-related reporting (as at 2019)

- Platform of the Saxon Ministry for Climate on climate risks (as at 2022)

- Discussion paper of the German Global Compact Network (as at 2019)

Step 2 - Defining scenarios for climate risks in risk management

The next step is to define scenarios for climate risks for the company. In order to avoid excessive analyses here and to offer practical solutions, we recommend defining the scope of consideration on the one hand and assumptions for future scenarios on the other.

Framework for considering climate risks in risk management

Possible assumptions for the Viewing framework of climate risks in risk management:

- Present and / or future: Do we assess the risks in terms of current value creation and / or in terms of future value creation?

- Example: For a manufacturing company that uses natural gas, climate-related risks relating to the current natural gas supply chain are integrated into risk management and / or future climate risks associated with lower-emission alternatives.

- value chain: Do we consider climate risks along the entire value chain or only in certain stages of the value chain?

- Example: For a manufacturing company that uses natural gas to generate process heat, we consider all stages of the value chain from natural gas extraction to the use and disposal of the product manufactured by the company with regard to climate risks OR, for example, only production from the procurement of natural gas to the sale of the product.

According to our understanding of the ESRS is the Consideration along all stages of the value chain upstream, downstream and own value creation necessary in the present and future.

Future scenarios for the assessment of climate risks in risk management

Possible assumptions for the Future scenarios for the assessment of climate risks in risk management:

- Regulatory framework: What (future) regulatory requirements do we expect?

- Example: A manufacturing company must assess whether its own industry will be subject to European emissions trading in the future, for example as a result of the planned extensions that have been decided in 2022 (Further information on the ETS extension).

- financing environment: What future dependencies between financing and climate risks do we assume?

- Example: For a manufacturing company with a high debt ratio, a correlation between future financing conditions and company-specific climate risks is to be expected. The background to this is the increasing regulation of capital providers with regard to climate risks.

- Market and customer requirements: What current and potential market and customer requirements does my company face?

- Example: A manufacturing company is a supplier to another company that is subject to the EU sustainability reporting obligation and, in the future, to EU supply chain legislation. As this company is subject to requirements for a 1.5 degree strategy for value creation, this also has an impact on its own company in the medium term.

The examples represent a selection of possible assumptions for scenarios. Such assumptions are necessary in order to be able to identify climate risks. At least one assumption should be made for each of the six risk types (see Step 1 - Define climate risks) of the TCFD definition framework for climate risks. With each cycle of risk controlling, the assumptions are then first reviewed and adapted to new developments and findings.

Step 3 - Identification of climate risks

Depending on the size of the company, the complexity of the value chain and market relevance, a more or less detailed examination of the value chain for climate risks is suitable for identifying climate risks. Climate risks can be identified along the value chain with the following responsibilities, for example:

- Upstream value creation" teamA team for the upstream value chain consisting of representatives from sustainability management, the strategic purchasing department and external experts. The need for external experts generally increases with increasing supply chain depth.

- Own added value" teamAnother team for the company's own value creation consisting of representatives from sustainability management, the product development and production departments. As the complexity of the manufacturing process increases, it makes sense to divide the "in-house value creation" team into sub-teams in order to ensure complete identification of climate risks.

- Downstream value creation" teamA team for the downstream value chain consisting of representatives from sustainability management, logistics, sales and customer service as well as internal or external experts for the use and disposal of the product. Internally, these experts are usually found among those responsible for product design and development.

The teams then analyse their respective value chain section with regard to the defined climate risks from step 1, taking into account the assumptions from step 2. The results are mapped in one or more matrix representations, depending on the scope (see figure: Example of a matrix for risk identification).

We recommend the following documents for more details on the identification of climate risks:

- CSR Risk Check - Enables the automatic creation of risk reports for commodities and products. It is also possible, for example, to narrow down to mining countries.

- Federal Environment Agency report on the management of climate risks in companies - The report identifies a large number of climate-related risks, in particular regulatory climate risks.

- Platform of the Saxon Ministry for Climate on climate risks - The platform identifies a selection of climate risks for municipal utilities.

Step 4 - Selection of identified climate risks

Once the risks have been identified in step 3, an initial selection is made in step 4. The result is a list of risks that are subjected to a detailed risk management assessment in step 5. In our experience, it has proven useful for all sustainability risks to draw up a perform a simplified materiality assessment. The two perspectives outlined in the introduction are applied here.

- Inside-out perspectivethe company causes risks to the environment and society (e.g. greenhouse gas emissions)

- Outside-in perspectiveRisks for the company due to developments in the environment and society (e.g. increasing extreme weather events)

In the case of climate risks from the inside-out perspective, the rough selection is based on their impact on the environment and/or society. However, as climate risks according to the TCFD definition are risks that affect the company from the outside (outside-in perspective), the selection is based on their impact on the environment and/or society. Selection of climate risks based on business relevance. This means that each climate risk identified in step 3 is assessed in terms of its impact on factors such as sales relevance, cost relevance, innovative strength and / or supply chain resilience. The assessment is carried out using a simple scale, such as "none, low, medium and high".

In our projects, surveys in particular have proven to be a useful tool for assessing climate risks. Participants in the surveys include, for example, management, supervisory board members, employees and external experts. The assessments of all respondents can then be summarised in a risk heat map (see figure: Example of a risk heat map). This form of visualisation quickly and easily shows the key climate risk areas for risk management.

Step 5 - Assessment of climate risks in risk management

In many cases, the result from step 4 can already be integrated into operational risk management. This is particularly the case if all risks in the existing risk management system - including climate risks - are based on consistent assessment factors and schemes. If, on the other hand, the system is categorised according to probability of occurrence and monetary loss potential, we must subject the material climate risks from step 4 to a more extensive assessment.

Assessment of climate risks for risk management according to probability of occurrence and monetary loss potential

The assessment of climate risks for risk management in terms of probability of occurrence and monetary loss potential can include the following steps:

- Selection of relevant financial key figurese.g. key figures based on operating, investment and financial cash flow on the basis of historical values and forecast future values.

- Definition of financial scenarios without climate risks: e.g. cash flow forecast for investment and debt sustainability and forecast for the operating margin. The forecasts depict various scenarios without taking climate risks into account (e.g. increase in interest rates on loans, loss of 15% of sales due to new competitors, etc.). Each scenario takes into account an expected probability of occurrence.

- Change in financial scenarios due to climate risks: The scenarios created are supplemented by the financial impact of the main climate risks. We use this to assess the extent to which the climate risks influence the respective scenario.

- Materiality with the help of significance thresholds: In a final step, we define significance thresholds for the financial impact. The thresholds differ in terms of the period under consideration. For example, if a climate risk in the short-term scenarios with a medium and high probability of occurrence (up to 2 years) has an impact of more than 5% on the key operating financial figures, it is categorised as a significant risk.

We recommend the following documents for more details on climate risk assessment:

- Questionnaire Climate Impact Check - Offer of the Competence Centre for Climate Change Impacts of the State of Rhineland-Palatinate. Simple questions are used to work through the steps of risk identification, selection and assessment.

- Tool - ClimateRisk-Mate - This is a very comprehensive Excel tool, including guidelines, which enables the detailed assessment of risks.

- Discussion paper of the German Global Compact Network - The paper provides a guideline for the development of an own assessment logic along all physical and transitory climate risks.

Conclusion

Climate risks will play an increasingly important role in the future of business. Whether from a regulatory perspective or for assessing supply chain stability, climate risks are part of the risk management of the future. Good risk identification and assessment makes it possible to develop sensible risk avoidance strategies and thus secure long-term survival and gain competitive advantages.

As there are already solid definitions for climate risks and a large number of tools are available, this risk category provides an introduction to the world of sustainability risks. Procedures can be developed on the basis of climate risks and then transferred step by step to other environmental and social sustainability risks.

[glossary_exclude]

Are you planning the next steps towards sustainability?

Ask me for a free information meeting.

I am ready with advice and pleasure.

Michael Jenkner

Sustainability strategy and reporting topics