Before reporting comes the double materiality analysis - Around 13,500 German companies are expected to have supplemented their traditional financial reporting with a sustainability report (non-financial reporting) by 2027. Comprehensive information on the topic of sustainability will thus become part of the management report, which is subject to mandatory auditing. The reason for this is the Corporate Sustainability Reporting Directive (CSRD)as part of the "European Green Deal", which aims to transform the European economy in a sustainable way. If companies have to report more information on the topic of sustainability, this will increase general transparency. It also improves the opportunities to align investments and business relationships with the information. Sustainability therefore pays off.

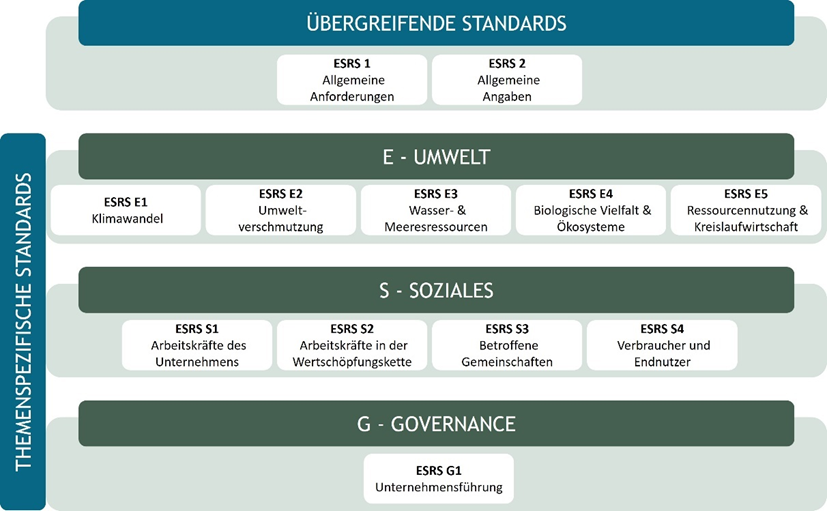

In the appendix of the CSRD you will find the European Sustainability Reporting Standards (ESRS). They stipulate what companies must report, when and how. The mandatory and voluntary content that is reported is derived from the results of a double materiality analysis.

We use the following article to provide a brief insight into the world of ESRS and requirements as well as initial experience with the double materiality analysis.

If you already have this basic knowledge, you will find in this blog article Links to practical guidelines for an industry solution for double materiality analysis. These have been developed in collaboration with the ASEW (Working Group for Economical Energy and Water Utilisation) and 60 municipal utilities.

Contents

- The structure of the ESRS

- The requirements of the double materiality analysis

- Conclusion and outlook

The structure of the ESRS

The ESRS are divided into overarching, topic-specific and sector-specific standards. The first two have been published to date. The topic-specific standards are divided into the areas of ecology or environment, social affairs and governance. They are based on the three ESG-dimensions: Enviromental, Social and Governance and describe the three areas of responsibility of a company.

Source: own presentation

The two overarching standards (ESRS 1 and ESRS 2) apply to all companies subject to reporting requirements. They regulate general disclosure requirements and specifications for the structure and preparation of sustainability reports.

The topic-specific standards follow a similar structure in the reporting areas. Not all reporting areas can be found in all topic-specific standards.

| Reporting area | Contents |

| Governance (GOV) | Procedures, controls and processes used to monitor, manage and supervise impacts, risks and opportunities. |

| Strategy (SBM for "Strategy and business model") | Interaction between business model and strategy, as well as dealing with the material effects, risks and opportunities |

| Management of impacts, risks and opportunities (IRO for "impact, risk and opportunity management") | This relates to the procedures used to identify IROs and to analyse them according to their Materiality and how strategies and measures were derived and implemented for these key sustainability aspects |

| Key figures and targets (MT for "metrics and targets") | The performance of a company, measured by key figures and defined targets and the interim status of achieving these targets. |

Source: ESRS 1, para. 12, p. 6

This means that companies reporting in accordance with the ESRS will disclose the strategies they are pursuing on various sustainability topics in the coming years. This includes information on the measures and targets they are pursuing to reduce their negative impacts and financial risks and to increase positive effects.

The results of the double materiality analysis show which topic-specific ESRS are to be reported.

But what exactly is the double materiality analysis?

The requirements of the double materiality analysis

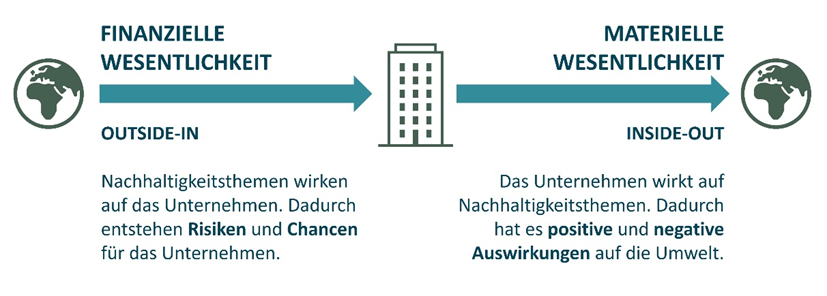

The aim of the double materiality analysis is to find out which of a large number of topics are particularly relevant, i.e. material, for a company. Two perspectives are adopted for this.

The two perspectives of the dual materiality analysis

Companies have sustainability-related impacts on people and the environment, such as nature or the climate. They may have already occurred (actual) or be possible in the future (potential). These effects are also referred to as "impacts". Another term for this perspective is "inside-out". The view from outside the company.

Sustainability issues and possible changes to them have an impact on companies. This can result in risks and opportunities. If they materialise, risks are associated with a negative financial impact on the company. A wide variety of environmental, social or governance issues can have a negative impact on a company's finances. These include, for example, the general financial situation, costs incurred or turnover. They can arise from events in the future or the past.

Opportunities, when they materialise, are associated with positive financial effects for the company. This refers to environmental, social or governance issues that have a positive impact on a company's finances.

Source: own presentation

In the double materiality analysis, these impacts, risks and opportunities (IROs) are identified, assessed and assigned to sustainability aspects. Sustainability aspects are overarching issues, or as the ESRS would say: "environmental, social and governance aspects". Human rights and governance factors". This corresponds to the three areas of the topic-specific ESRS. Reporting obligations are derived from each sustainability aspect that a company identifies as material in the double materiality analysis. A sustainability aspect is material if it is associated with significant impacts, risks or opportunities for a company. Accordingly, a sustainability aspect can be material from the inside-out, outside-in or both perspectives. They can be formulated in very specific or general terms. One example from the ESRS is: "Labour in the Value chain" as a topic, "working conditions" as a sub-topic derived from it and "working hours" as a sub-sub-topic derived from it.

In addition to the two perspectives, there are further requirements that must be taken into account when implementing the dual materiality analysis.

The three time horizons short, medium and long term

The effects, risks and opportunities are analysed in three time horizons:

- Short-term: 1 year, as the period of (financial) reporting

- Medium-term: 1-5 years (end of short-term time horizon up to 5 years)

- Long-term: Over 5 years

The number of years is a recommendation of the ESRS. If it makes sense for the company, they can be adjusted with a justification. This consideration provides the necessary foresight for subsequent strategy development in order to minimise risks and negative effects and exploit opportunities.

The value chain(s)

The entire value chain is considered in the double materiality analysis. A company may have one or more value chains if, for example, it offers different products. The ESRS require companies to consider their business activities and the associated upstream and downstream value chain when analysing materiality. The business activity includes what happens within the company and therefore its own direct sphere of influence. The upstream value chain goes back to the extraction of raw materials. The downstream value chain extends to the disposal of products and services after use. The company therefore shares responsibility for the entire value chain, even if it cannot always influence everything directly.

The interested parties or stakeholders

Stakeholders should be included in the double materiality analysis. A distinction is made between the affected stakeholders and the users of sustainability statements.

The affected stakeholders are individuals or groups who are positively or negatively affected by a company's activities. Both through direct and indirect business relationships and across the entire value chain. Examples of affected stakeholders include suppliers, consumers, customers, authorities and local communities. "Silent stakeholders" are a speciality. By this, the ESRS means nature, which cannot speak for itself. To represent this perspective, environmental data, data on the conservation of species or experts can support the materiality analysis.

Users of sustainability statements, for example, already use general financial reporting because they have a financial interest in the company. These include investors or credit institutions. There are also other users of the sustainability statement, such as trade unions, business partners, NGOs or scientists.

The ESRS do not provide clear guidelines on how the Stakeholders are to be involved. It is only stipulated that the perspective of the affected stakeholders and users must be included. Whether surveys, interviews, studies or workshops with representatives are used for this purpose is the decision of the reporting company.

Methods and best practice for sustainability in your mailbox

Conclusion and outlook

We would like to emphasise that there is a lot to consider when implementing a double materiality analysis. This is particularly important because the reports and the path to them are audited by an auditor.

The first support programmes are already in place. The EFRAG has three guidance documents published. On the implementation of the double materiality analysis, value chains and the data points in the ESRS. The The German Sustainability Code (DNK) has also published initial offers of support. Among other things, a first brief guide to the double materiality analysis and the formulation of impacts, risks and opportunities (IROs). In addition, there is the new DNK platform, as a free toolabout which the Sustainability reporting can be realised.

Since the beginning of 2024, we have been supporting double materiality analyses in accordance with the ESRS requirements. In one of these projects, together with our cooperation partner the Municipal utility network ASEW (Working Group for Economical Energy and Water Utilisation) is working on an industry solution for and with municipal utilities. The results will be summarised in practical guidelines and published at the beginning of 2025.

In several parts, the contents of the overarching and topic-specific requirements of the ESRS are explained, the individual steps and requirements of the double materiality analysis are discussed in more detail and the entire procedure in the project is described transparently and comprehensively and made freely accessible to the public. The latest publications can be found under this blog article.

We are delighted to be part of this project and hope you enjoy the further content.

Would you like to strategically position your company for sustainability and position yourself for the German Sustainability Award?

Contact us - we will support you with our sound experience and concrete solutions.

Michael Jenkner

Sparring partner for sustainability transformation and resilience

[...] and CSRD reporting obligations, we recommend our blog post "Insights into the double materiality analysis according to the European Sustainability Reporting Guidelines .... as an initial overview More comprehensive guidelines, which we developed together with the municipal utility network ASEW [...]